Streamlining Efficiency and Accuracy: A Comprehensive Guide to Payroll Management Software

- solutionscakiweb

- Mar 5, 2024

- 3 min read

Introduction:

In today's fast-paced business environment, managing payroll efficiently is crucial for the success of any organization. As businesses grow, so does the complexity of managing employee compensation, deductions, and compliance with ever-changing tax regulations. To address these challenges, businesses are turning to payroll management software to streamline processes, enhance accuracy, and ensure compliance. In this comprehensive guide, we will explore the key features, benefits, and considerations of payroll management software, shedding light on how it can revolutionize your payroll processes.

I. The Evolution of Payroll Management Software:

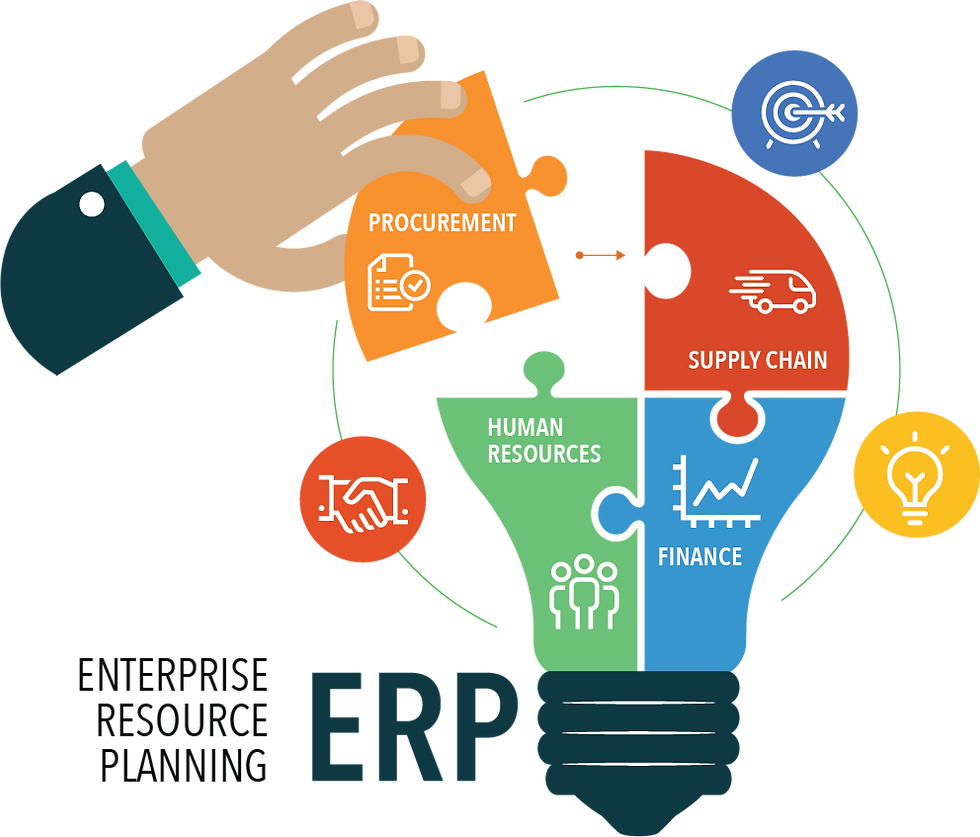

Payroll management has come a long way from manual calculations and paper-based systems. Early payroll systems were basic, often limited to basic salary calculations and tax deductions. With advancements in technology, payroll management software has evolved into sophisticated solutions that encompass a wide range of functionalities. Modern payroll software not only automates calculations but also integrates seamlessly with other HR and finance systems, offering a holistic approach to managing employee compensation.

II. Key Features of Payroll Management Software:

Automated Payroll Processing:

Eliminate manual errors and reduce processing time with automated payroll calculations.

Set up recurring payments and automate tax calculations to ensure timely and accurate payroll processing.

Tax Compliance:

Stay up-to-date with ever-changing tax laws and regulations.

Automatically calculate and deduct federal, state, and local taxes, minimizing the risk of compliance errors.

Employee Self-Service Portals:

Empower employees with self-service portals to access pay stubs, and tax forms, and update personal information.

Streamline communication by providing a centralized platform for employees to address payroll-related inquiries.

Integration with HR and Accounting Systems:

Enhance overall efficiency by seamlessly integrating payroll software with HR and accounting systems.

Ensure consistency in data across different departments, reducing the likelihood of discrepancies.

Time and Attendance Tracking:

Monitor employee work hours accurately through integrated time and attendance tracking.

Automate overtime calculations and ensure compliance with labor laws.

Customizable Reporting:

Generate customized reports to analyze payroll data, track expenses, and facilitate decision-making.

Access real-time insights into payroll costs, helping businesses make informed financial decisions.

III. Benefits of Payroll Management Software:

Time and Cost Savings:

Reduce the time spent on manual calculations and paperwork, allowing HR professionals to focus on strategic tasks.

Minimize the risk of errors that can lead to costly compliance issues.

Enhanced Accuracy:

Automation reduces the likelihood of human errors in payroll processing.

Accurate calculations and timely payments contribute to employee satisfaction and trust.

Compliance and Risk Mitigation:

Stay compliant with tax laws, labor regulations, and reporting requirements.

Minimize the risk of penalties and legal issues by ensuring adherence to all applicable rules.

Improved Employee Satisfaction:

Provide employees with easy access to payroll information through self-service portals.

Timely and accurate payments contribute to a positive work environment and employee morale.

Scalability:

Grow your business without worrying about outgrowing your payroll system.

Scalable payroll software can adapt to the changing needs of your organization.

IV. Considerations When Choosing Payroll Management Software:

Scalability:

Ensure that the software can scale along with your business growth.

Evaluate the software's capacity to handle an increasing number of employees and transactions.

User-Friendly Interface:

Opt for software with an intuitive interface to facilitate easy navigation and use.

User-friendly design reduces the learning curve for employees and administrators.

Security Features:

Prioritize software with robust security features to protect sensitive payroll data.

Look for encryption, secure login processes, and compliance with data protection regulations.

Integration Capabilities:

Choose software that seamlessly integrates with existing HR, accounting, and timekeeping systems.

Integration enhances data accuracy and eliminates the need for manual data entry.

Cost and ROI:

Evaluate the total cost of ownership, including initial setup costs and ongoing subscription fees.

Consider the return on investment in terms of time saved, error reduction, and improved efficiency.

Conclusion:

In conclusion, payroll management software plays a pivotal role in modernizing and optimizing payroll processes. From automating calculations to ensuring tax compliance and enhancing employee self-service, the benefits of adopting a robust payroll solution are numerous. As businesses continue to evolve, investing in scalable and feature-rich payroll management software is not just a necessity but a strategic move toward fostering efficiency, accuracy, and overall organizational success. By carefully considering key features and conducting thorough evaluations, businesses can choose the right payroll management software that aligns with their unique needs and propels them toward a future of streamlined payroll processes.

Comments